Today, B2B deals are increasingly long, involve more stakeholders, and shift course mid-cycle. That makes traditional forecasting (based on past performance or manual updates) dangerously unreliable.

RevOps leaders need more than historical data. You need real-time visibility into pipeline health, deal risk, and future performance. You need to know what’s likely to close before the end of the quarter, not after you miss it.

That’s where predictive analytics and AI-powered forecasting step in. These tools don’t just report, they anticipate. They analyze patterns across touchpoints, identify hidden risks, and guide your GTM team with precision.

The shift toward predictive analytics in sales forecasting

Predictive analytics uses machine learning and statistical modeling to forecast outcomes before they happen. In sales, that means analyzing patterns in buyer behavior, deal progression, and rep activity to predict which opportunities will close and when.

It moves beyond the question of “What happened?” to tell you what’s going to happen next.

Rather than treating each deal as a standalone bet, predictive models ingest thousands of data points across your CRM, email, calendar, buyer engagement, and more. Then they surface insights your team would never catch manually.

Predictive forecasting is a top priority for today’s businesses.

McKinsey’s 2025 AI in the Workplace report just revealed that 92% of execs expect to boost AI spending over the next three years. And 55% say they expect their investment to increase by at least 10% during that timeframe.

For AI-powered predictive analytics, specifically, Market.us reports that more than half of companies will adopt it by the end of 2025 (if they haven’t already). And ~85% of enterprises already include predictive analytics in their strategic decision‑making.

Predictive vs. historical forecasting

Most sales forecasts rely on lagging indicators like closed revenue, rep-entered deal stages, and gut-based confidence scores. That’s reactive. It tells you what has happened, or what someone hopes will happen.

Predictive analytics flips that model.

Instead of basing forecasts on human input, it builds them from behavioral data: how buyers engage, how reps act, and what similar deals looked like. This removes bias, reduces sandbagging, and uncovers risk in real-time.

If historical forecasting is a rearview mirror, predictive is your forward-facing radar.

Why this matters for RevOps (practically, not theoretically)

Here’s what you actually gain from this:

- Earlier signal on at-risk deals. Predictive models detect drop-offs in buyer engagement or key milestone slippage before you’ve lost the deal. You don’t have to wait for the bad news and wonder where or why it happened.

- More accurate forecast calls. With a modern CRM or CPQ platform, AI weighs every deal based on dynamic risk factors, not just deal stage. That means fewer surprises at EOQ and less overcommitting to the board.

- Smarter pipeline prioritization. Predictive insights highlight which deals deserve attention, which are wasting your time, and which reps need coaching. Sales leaders can go off of hard data instead of hunches.

- Tighter alignment with marketing and CS. Predictive analytics gives you a cross-functional picture of your funnel. You’ll know what’s converting, what’s not, and where GTM handoffs fail.

- Freedom from spreadsheet chaos. There’s no more tribal knowledge buried in manual roll-ups. Forecasting becomes continuous, centralized, and reliable.

Deep insights for predictive deal forecasting

Forecasting requires you to understand the deals you’ve closed and the ones in your pipeline in a more comprehensive way compared to reporting alone. A major tenet of predictive AI is that it doesn’t just automate data analysis, it sees the things you can’t (or, at least, can’t at scale).

It sifts through millions of signals across your pipeline to show you the truth behind your numbers: what’s solid, what’s slipping, and what needs intervention ASAP.

Spot patterns you’d never notice.

AI models find repeatable behaviors across deals, reps, regions, and products. It identifies which rep behaviors correlate with wins. Which sequences get responses. Which territories close fastest. And where deal velocity consistently stalls.

It’s not anecdotal. It’s mathematically grounded, and always up to date.

Score deals with precision, not hope.

AI assigns dynamic win probabilities based on buyer engagement, stakeholder activity, deal age, and historical close patterns, rather than rep-input stages or notes.

This gives you a real forecast. You’ll know which deals are on track, which are dragging, and which are already dead (even if they’re still in commit).

Get ahead of risk before it’s too late.

Predictive signals tell you when a deal is veering off course. Maybe the economic buyer dropped out. Maybe meetings went cold. Maybe key steps are missing entirely.

Whatever the case, AI flags the issue early, giving you time to course-correct instead of cleaning up the mess later.

Make pipeline reviews actually useful.

AI analytics have shown to increase forecast accuracy by 20-30% compared to traditional methods. The reason for this is that when your data is reliable and scored with predictive context, it factors in variables that you’d otherwise miss while simultaneously eliminating bias.

When that happens, you’ll walk into pipeline reviews knowing:

- Which deals to focus on

- Which reps need coaching

- Where risk is most concentrated

- How much revenue you’ll realistically close

That makes it a lot easier to make high-level decisions for your sales org.

Agentic AI empowers reps and RevOps with smart automation

When people hear the word “agentic,” they tend to think it’s similar to an agent or chatbot.

Agentic AI is more than just a chatbot. It’s AI that can reason, take action, and autonomously drive workflows forward. Instead of waiting for humans to interpret data and decide next steps, agentic AI takes initiative. It flags what’s wrong, suggests what to do, and, in many cases, does it for you.

For RevOps and sales teams, that means less manual busywork and more time spent actually moving revenue.

AI assistants are now embedded into your workflow.

You’re already seeing it:

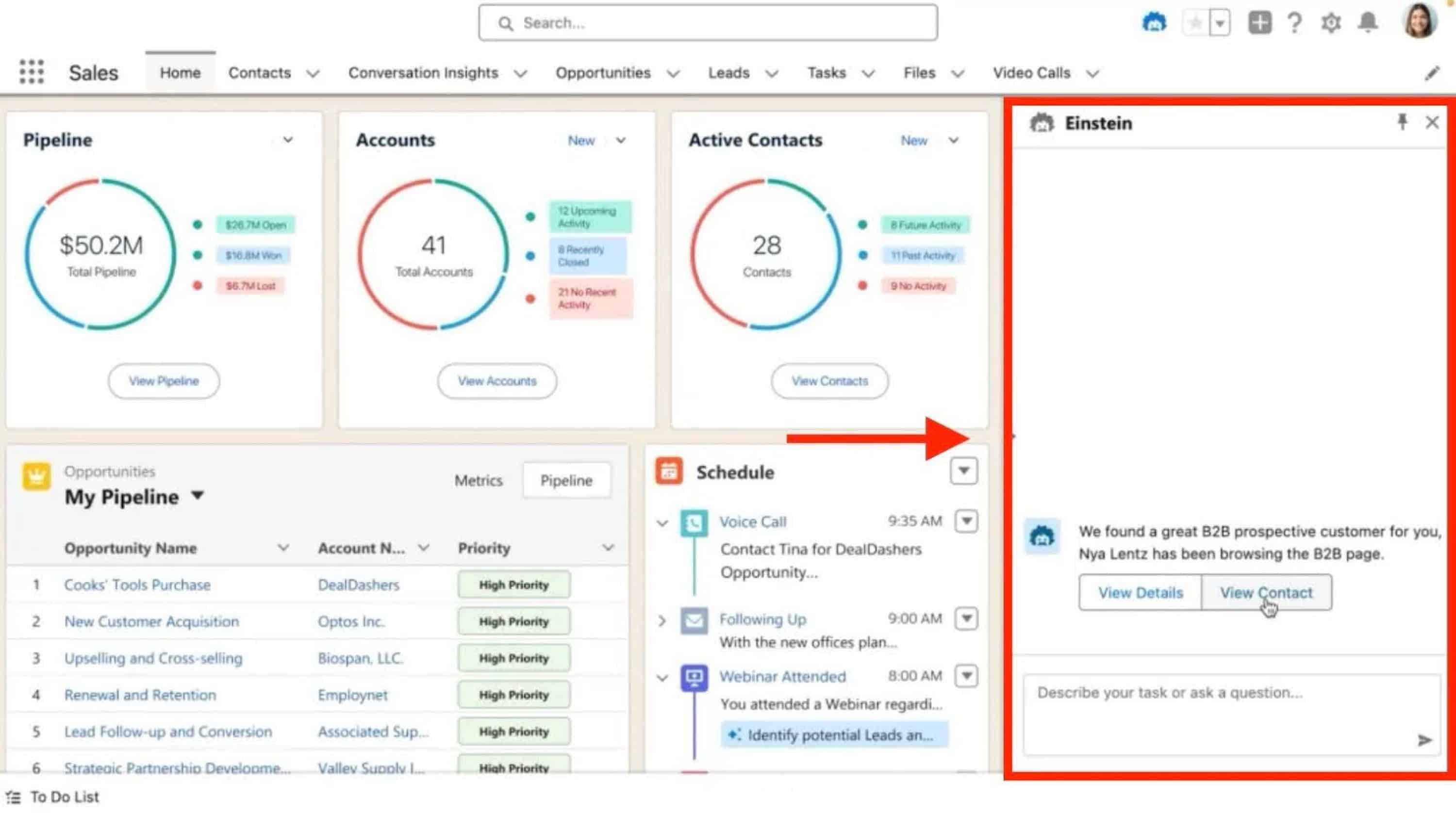

Salesforce AgentForce pulls insights from your pipeline, flags stalled deals, and recommends next-best actions inside the CRM. You can even use it for things like practicing your sales pitch.

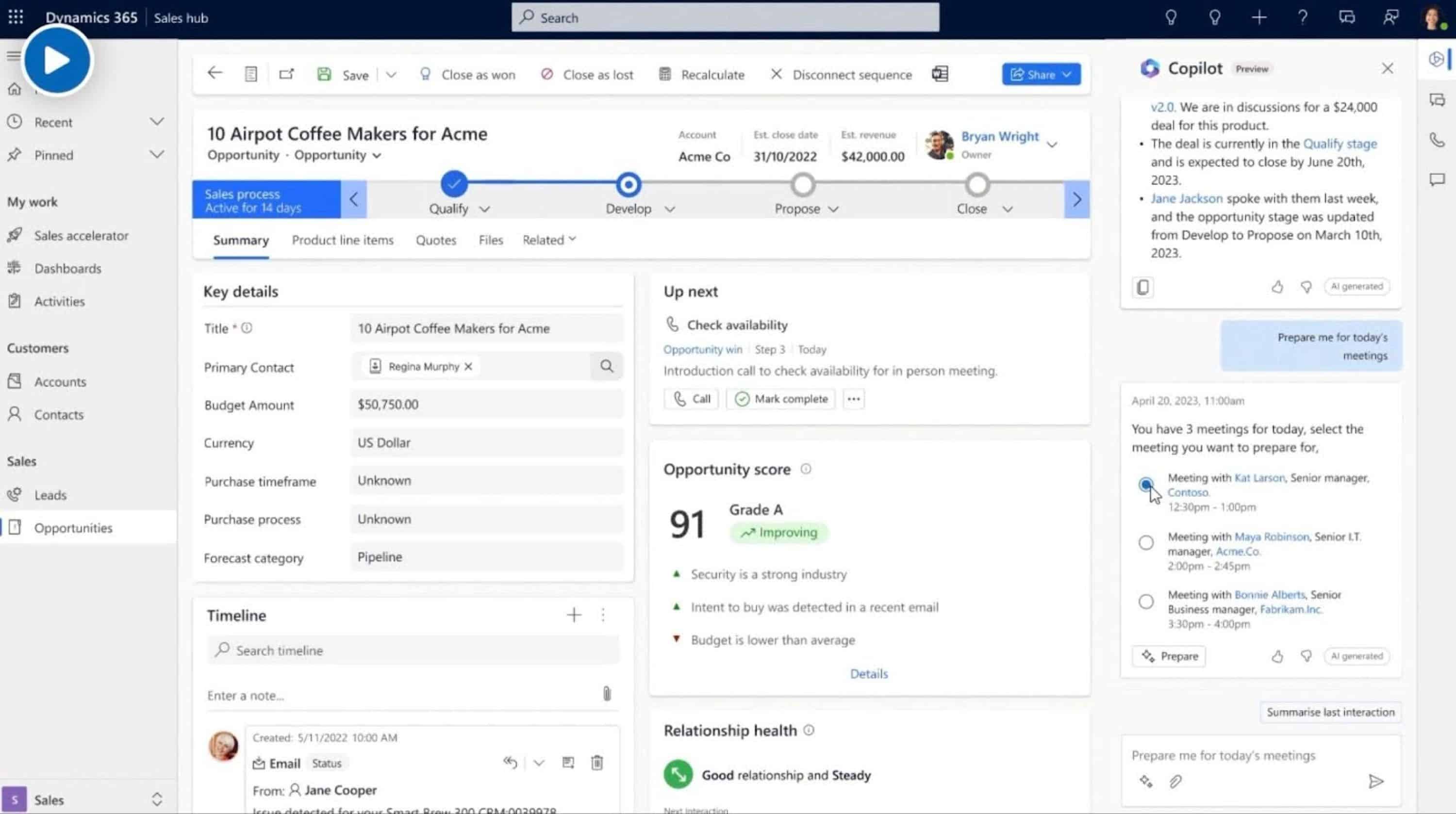

Microsoft Copilot syncs with Outlook, Teams, and Dynamics to prep deal summaries, suggest follow-ups, and recap sales calls—without you lifting a finger.

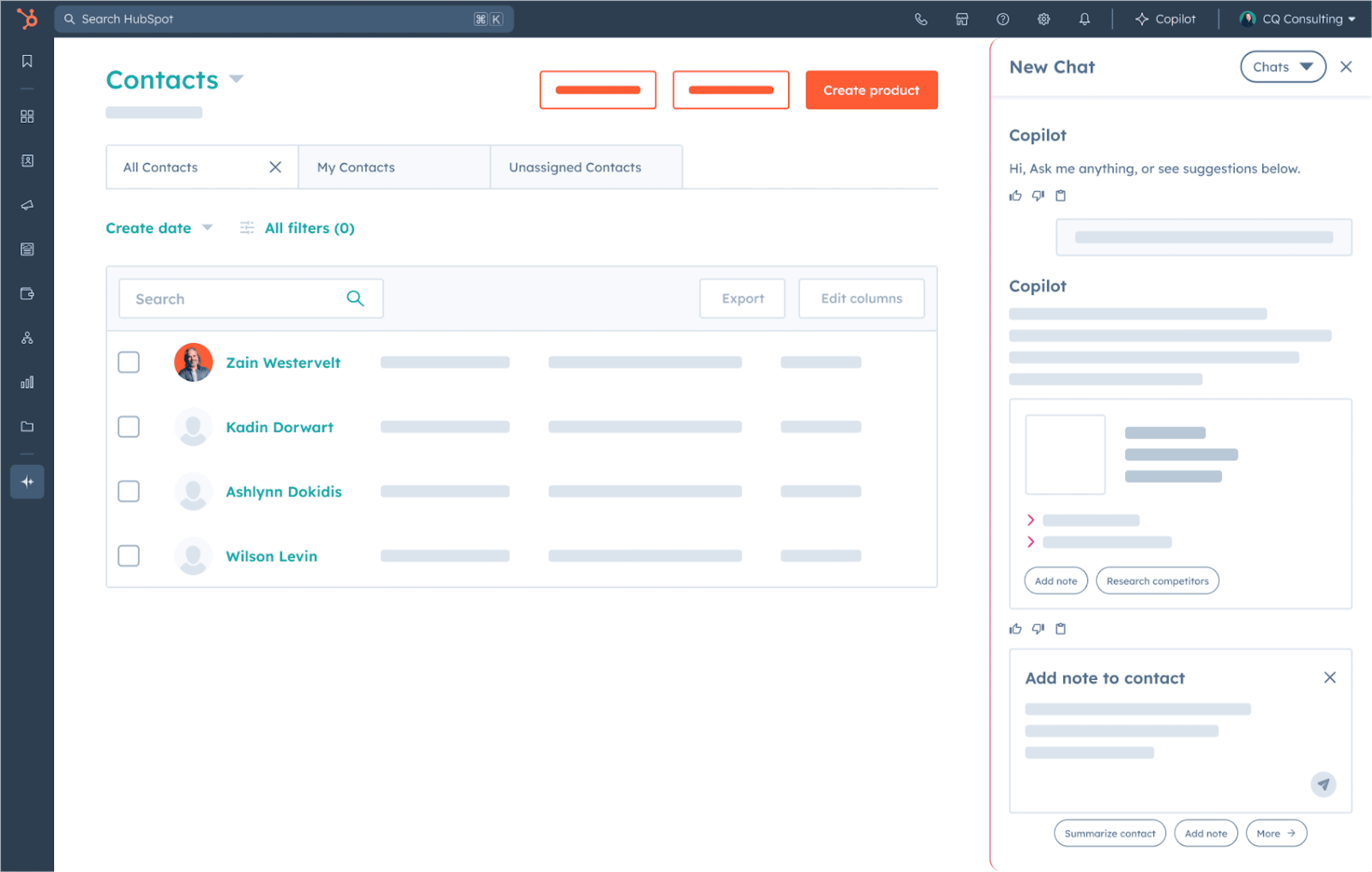

HubSpot Breeze proactively alerts reps when buyer engagement drops, and auto-generates outreach tasks to re-engage.

We’re seeing this in CPQ software, too. DealHub CPQ is the perfect example of this. With DealHub, you get AI-guided selling motions, contextual sales playbooks and enablement content, dynamic quote generation, and real-time pricing logic all embedded directly into your selling workflow.

We’ve now reached the point where predictive AI can help us complete entire workflows with next-best actions, moving beyond data and mere “insights.”

Actionable guidance in real time.

With agentic AI, you’re not only seeing the data. You actively get told what to do with it, which helps you get far more out of your software and the analytics it produces.

- “This deal’s gone 10 days without buyer interaction. Send a re-engagement email.”

- “You haven’t looped in procurement, but similar deals stalled here. Introduce them now.”

- “Based on current activity, this deal is now forecasted to slip to next quarter. Adjust your commit.”

This kind of real-time nudging helps your sales reps act with more conviction and prioritize their energy on the right deals. The typical rep spends just 28% of their time actually selling, and even less time selling to the ideal prospect. This serves to fix that issue.

The end result is not just that the seller can sell more confidently, but that they’ll increase conversion rates, sales velocity, and, through value-added upsells and cross-sells, possibly even deal sizes.

Unified data streams are essential for forecast accuracy.

Even if you have the AI tools built into your workflow, you won’t be able to forecast accurately in the way we’re discussing if your data is scattered.

Disconnected CPQ, CRM, ERP, and ecommerce systems create friction at handoff points between those tools throughout the process. That, in turn, creates blind spots that break forecasting.

If sales lives in Salesforce, pricing lives in your CPQ tool, and finance info is in your ERP, but absolutely none of those are actually interconnected, you’re making calls on partial information.

Unified data streams solve this. When these platforms are connected, you get real-time visibility across the entire revenue engine. Sales knows what’s been quoted. Finance knows what’ll most likely close. Ops can see how fulfillment and inventory will impact delivery.

What connectivity actually means in practice

A deal gets configured in CPQ? It updates automatically in your CRM forecast. Finance changes a discount policy in ERP? Sales sees it reflected instantly in quote templates. A buyer engages through your eCommerce portal? It shows up in their 360-degree customer profile.

It’s important to remember that interconnectivity and system integration aren’t just about convenience (though that is an important tangible benefit). They’re about enabling cross-functional alignment and continuous forecasting that reflects current market realities.

Eliminating data silos for more precise forecasting

Siloed data leads to guesswork and errors, as we’ve already established. Fixing it requires:

- Integrated platforms. Connect your CPQ, CRM, ERP, and support tools through native integrations or middleware (e.g., MuleSoft, Workato).

- Shared data models. Standardize key fields like revenue stage, product SKUs, pricing logic so they sync across systems.

- Governed workflows. Define clear rules for data ownership, validation, and update cadence to keep everything aligned.

When your systems talk to each other, your forecasting models become exponentially smarter and less prone to human error.

Tangible benefits across the sales process

Unifying your data helps RevOps, yes. But it makes everyone faster and sharper as well.

- AI-driven enablement tools deliver content mapped to real-time buyer behavior.

- Quotes and proposals update faster, with fewer errors, thanks to synced pricing and product data.

- Pricing strategies stay consistent across channels, whether it’s enterprise sales, self-serve, or partner-led.

- Forecast dashboards show the full picture: booked, projected, at-risk, and upside revenue across all your segments and teams.

Forecasting accuracy isn’t a data problem. It’s a connectivity problem. And the teams solving it today are the ones building scalable, predictable growth for tomorrow.

Outcomes of AI-driven forecasting

AI-enabled forecasting is about real, measurable outcomes that drive revenue forward. Let’s break down what that actually looks like on the ground.

Agility: Respond to change without losing the quarter.

Markets shift fast. Buyer behavior evolves. Pricing models change overnight. With traditional forecasting, your team scrambles to react. With AI-driven forecasting, you adapt in real time.

Example: A SaaS company notices enterprise buyers suddenly pausing multi-year deals. Predictive models flag this trend early, prompting the team to shift focus to mid-market monthly contracts, saving the quarter and avoiding forecast blowback.

Dynamic quoting and pricing: Maximize revenue on the fly.

When forecasting is powered by AI, pricing doesn’t have to be static. You can adjust quote logic in real time based on deal context, like buyer size, urgency, or risk profile.

Example: Conga uses AI-driven CPQ to surface optimal pricing bands based on deal data and previous wins. This lets reps tailor quotes with the highest likelihood of acceptance and profitability.

GTM acceleration: Focus on deals that actually close.

AI doesn’t just clean up your pipeline, it prioritizes high-value and high-potential deals. When reps know which deals are most likely to close, they stop wasting time on noise. And when RevOps can trust the data, they can model their ICP a lot more effectively, which is info marketers and BDRs/SDRs use to improve their targeting.

Example: Companies using AI-powered forecasting tools like Clari report shorter sales cycles and faster pipeline velocity, simply by focusing reps on the most winnable opportunities.

Predictive analytics has redefined sales forecasting

Sales forecasting used to be about projecting based on past performance and rep instinct. That era is long gone.

AI-powered CPQ and predictive analytics have redefined what forecasting means, transforming it from a reactive chore into a strategic advantage. You now have the power to see around corners, adapt your GTM motion in real time, and course-correct before revenue is at risk.

For RevOps leaders, this means three things:

- Accuracy. No more inflated pipelines or surprise misses. Just clean, data-backed projections.

- Speed. Faster quoting, faster deal cycles, faster responses to market change.

- Control. You see what’s happening across the entire funnel and can intervene before it’s too late.

The takeaway is that predictive deal insights aren’t optional anymore. They’re the key to confident, scalable, data-driven execution across every stage of your GTM strategy. Embrace them now, and get ahead while others are still catching up.

Andrew is a professional copywriter with expertise in creating content focused on business-to-business (B2B) software. He conducts research and produces articles that provide valuable insights and information to his readers.