For years, configure-price-quote (CPQ) projects have struggled, with failed adoption rates reported as high as 67% for legacy CPQ solutions. Operators tell us this isn’t just an implementation problem. It reflects a deeper mismatch between how CPQ has been delivered and what modern go-to-market teams need.

The first wave of large suites (Salesforce, SAP, Oracle) pulled CPQ into their ecosystems via acquisitions. Many leaders say this tethered CPQ too closely to IT systems and distanced it from the commercial teams it was supposed to empower.

Now, a second wave of consolidation is underway, mimicking the past but adjusting to the new GTM revenue motions that extend beyond direct sales.. HubSpot, ServiceNow, and Thoma Bravo are using acquisition strategies to integrate CPQ into broader platforms. Salesforce is taking a different path this time, sunsetting the previously acquired Steelbrick CPQ to rebuild on their core platform. Many leaders we have spoken with recognize the appeal of a single vendor ecosystem, but many also voice concerns that the same structural challenges could reappear.

This is the context for launching CPQ Analyst Insights on cpq-integrations.com, to become a space to share what operators and GTM leaders are really saying about this evolving market, and provide insights to solutions to key challenges to embrace the opportunities in front of us.

The Narrative vs. Reality

The prevailing story is that all-in-one platforms create simplicity and control. Leaders acknowledge those benefits but also point to tradeoffs.

The concern raised most often: these models can feel designed to reinforce a vendor’s ecosystem rather than enable a company’s unique GTM strategy. They can be hard to extend beyond direct sales motions into channels like PLG, partner selling, or digital commerce. Nor will it provide operators the agility to adapt to real-time GTM strategies to provide the guided governance and guardrails for emerging AI automation.r Salesforce CPQ, but this ‘replacement’ has not yet been built.

Market Signals

In recent conversations, three themes keep surfacing:

- Multi-Channel GTM Complexity: Companies increasingly sell through reps, partners, marketplaces, and self-service. Leaders question whether CPQ tied to one system can support every channel.

- AI as an Execution Layer: Revenue leaders want AI that doesn’t just analyze data but orchestrates workflows across the stack. There’s skepticism about whether this is possible inside closed platforms.

- RevOps Push for Agility: RevOps teams want composable stacks that adapt to changing strategy. Operators say rigid suites often require the business to adapt to the software instead.

Operator Questions

These are the kinds of questions surfacing repeatedly:

- “How will this platform support partners who don’t work in our CRM?”

- “Can our configuration logic extend to e-commerce for PLG without major redevelopment?”

- “What happens when we need to integrate a new best-of-breed tool next year?”

CPQ as a System of Work

The feedback from GTM leaders is consistent: the decision to adopt consolidated suites carries real tradeoffs. On one side, potential efficiency and alignment. On the other, risks of reduced agility, vendor lock-in, and difficulty adapting CPQ logic across diverse sales channels.

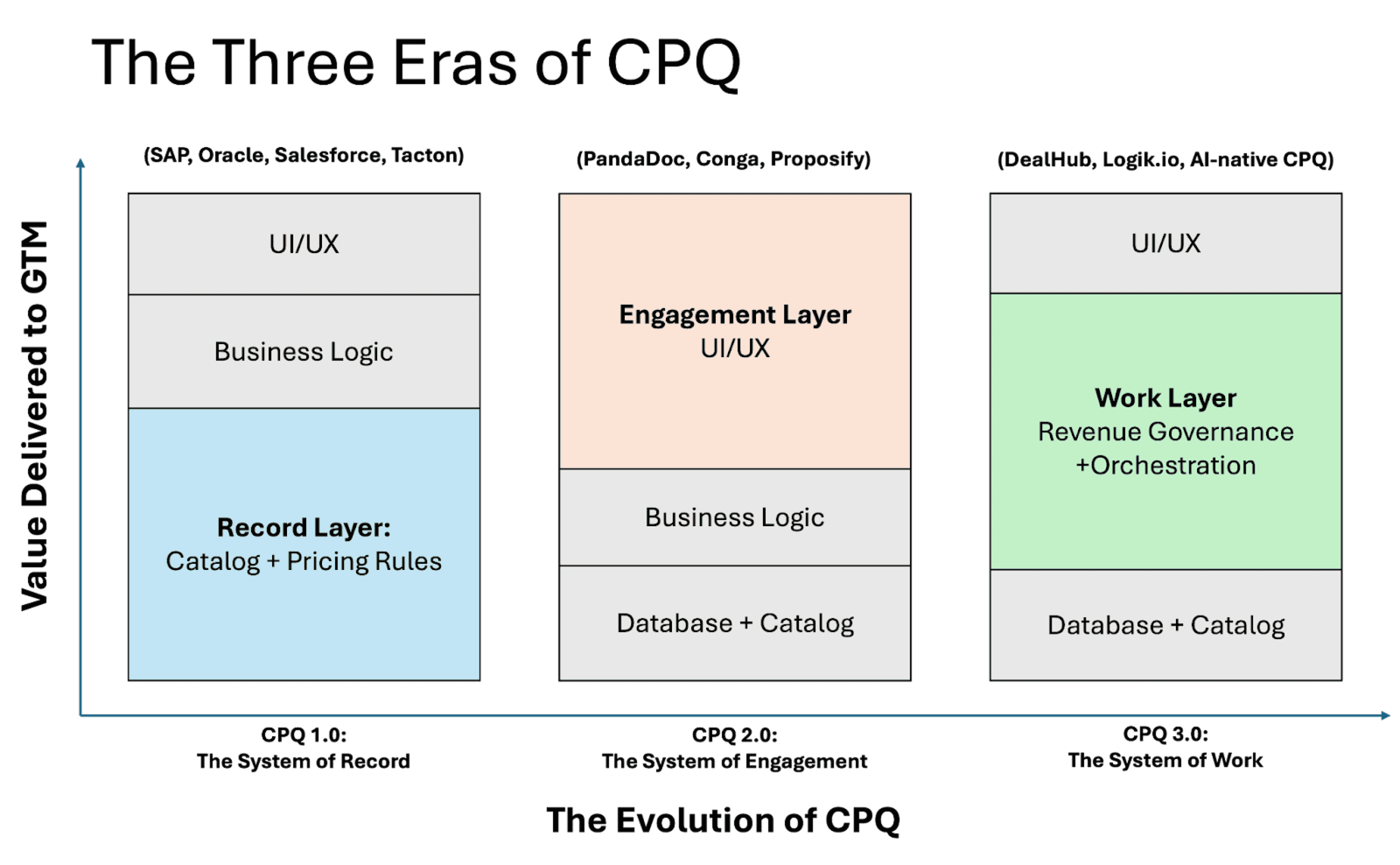

The alternative vision operators point to CPQ as an independent System of Work, borrowing a concept from Derek Xiao over at Menlo Ventures. Instead of being a buried feature, CPQ becomes the commercial logic layer that connects every channel to a unified revenue strategy. GTM leaders are describing this as CPQ shifting from a passive record keeper to the active orchestration engine for revenue execution.

CPQ Analyst Insights

For the first time, the technology is available to solve the disconnect between GTM strategy and operational reality. The rise of AI and composable architecture means we can finally build the revenue engines we’ve always talked about, systems that don’t just record what happened, but intelligently orchestrate what happens next.

This is why the current wave of consolidation feels so dissonant to operators. It’s a retreat to an old architectural model at the very moment a new one is becoming possible. The future of revenue execution won’t be won by the deepest integration into a single CRM. It will be won by the most open, intelligent, and channel-agnostic System of Work. Building, understanding, and championing this new execution layer is the most important work we can do. This is the conversation CPQ Analyst Insights is here to lead.

The CPQ Integrations Team shares expert insights on revenue operations, CPQ, and quote-to-cash innovation. We explore how connected systems and AI-driven automation transform CPQ from record-keeping tools into revenue-accelerating engines for modern B2B companies.